“History reports that the men who can manage men manage the men who can manage only things, and the men who can manage money manage all.”

This is the second version. Click here for the first version.

❓ What You’ll Learn

- What is decentralized finance?

- How are NFTs being collateralized?

- What’s credit delegation?

- How to create crypto ETFs?

- How to get paid in crypto?

- Why are we seeing the separation of money and state?

- What are the top DeFi communities?

💎 Why It Matters

We’ve seen the separation of church and state.

We’re seeing the separation of money and state.

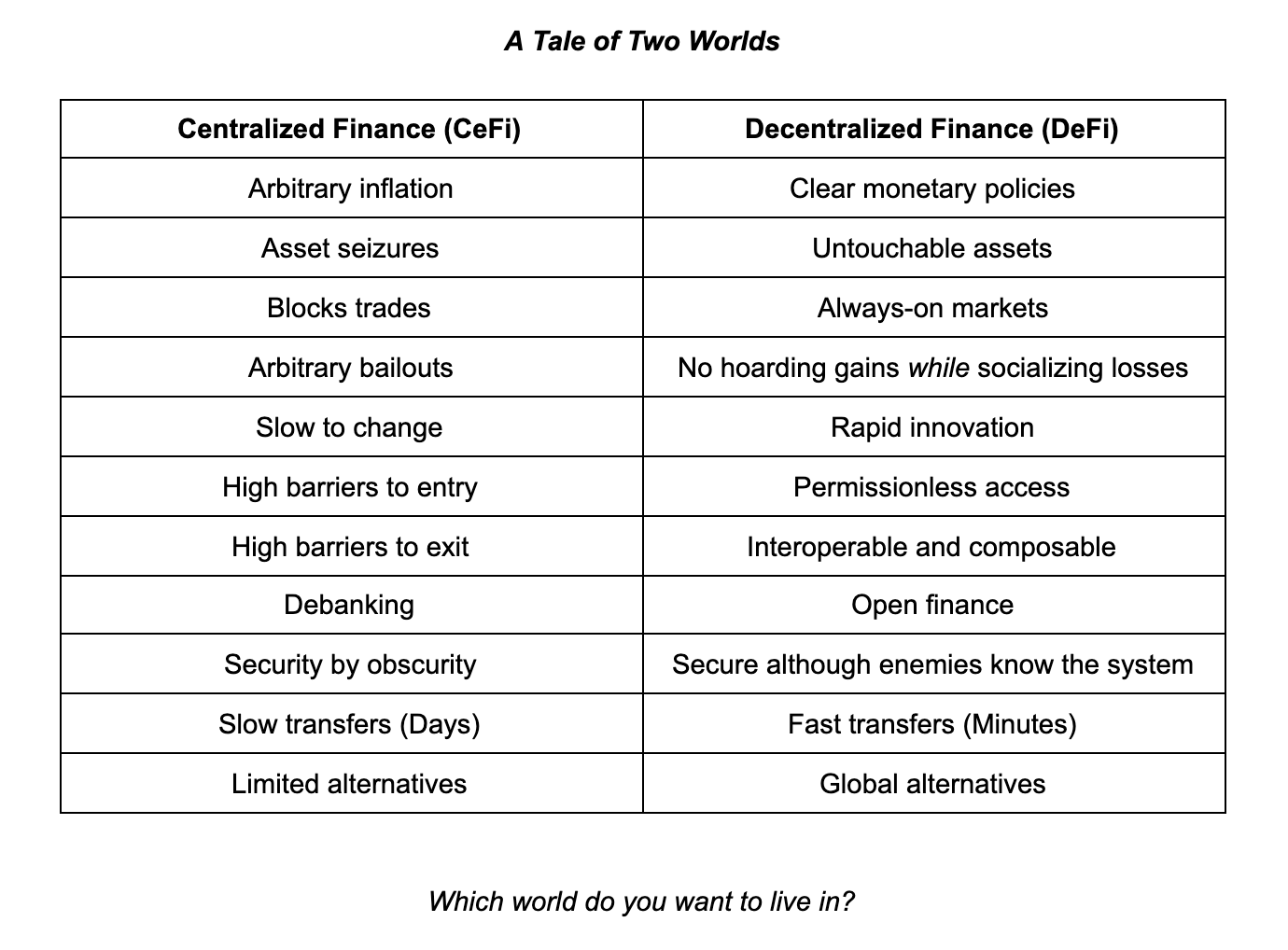

🔍 Problem

Nations have a reputation for corruption, protectionism, inflation, bailouts and seizures.

Centralized financial institutions help them while blocking trades, debanking users and more.

Absolute power corrupts absolutely.

But things are changing…

💡 Solution

Decentralized Finance (DeFi) is made up of user-owned and controlled financial networks. DeFi brings transparency and fairness to lending, borrowing, storing, trading and more.

🏁 Players

Lend + Borrow

- Aave • Borrow crypto and earn interest on deposits.

- Compound • A lending protocol built for developers.

- dYdX • A trading platform with lending and borrowing. Aimed at experienced traders.

- Cream • A lending protocol based on Compound.

Trade

- Uniswap • Decentralized token exchange.

- SushiSwap • A fork of Uniswap that added governance tokens.

- 1inch • An aggregator using multiple exchanges to limit price slippage.

Farm

Index

- DeFi Pulse Index • An index token tracking DeFi projects.

- Indexed Finance • A collection of index pools.

Bet

Insure

- Cover • Peer-to-peer insurance.

- Nexus Mutual • Protection against smart contract bugs.

Tokenize

🔮 Predictions

- NFTs will be collateralized. NFTfi is a marketplace for P2P loans. NFT loans, like NFTs, will be tokenized.

- Traditional investors will have access to long-tail cryptocurrencies. GBTC, ETHE and Bitwise 10 are just the beginning. See crypto-focused IRAs like Choice and Alto.

- Uncollateralized and undercollateralized loans will become common. See Union Protocol, Goldfinch, Teller and TrueFi. Aave recently released credit delegation.

- Laws will continue to lag. Technology moves faster than legislators. Is wrapping bitcoin a taxable event? How should rDai and cUSD be treated? These are open questions.

☁️ Opportunities

- Join communities to immerse yourself in DeFi. Bankless is an early mover.

- Earn crypto. Gitcoin lets you “work for the internet.” Lewis Freiberg earns his highest salary ever ($180,000) as a community manager for ESD.

- Get exposure to baskets of assets. Be bullish on DeFi without the need to pick winners. PieDAO, DPI and Indexed Finance help you index.

- Earn on idle crypto. Aave and Compound are decentralized options. BlockFi and Celsius are centralized.

- Build a DeFi newsletter and/or community. It’s early days. The market matters most.

🔑 Key Lessons

- DeFi is unstoppable. There’s no single point of failure. Nations that attempt to ban crypto set citizens behind culturally and financially.

- We’re living in a lag. Strong property rights, programmable money and permissionless loans are here. Awareness isn’t evenly distributed.

- DeFi is antifragile. Hacks strengthen the system. Bans prove the need for DeFi. Like Hydra, when one head is cut off, two grow in its place.

- DeFi brings creative destruction to CeFi. Yield farming, flash loans and AMMs are unprecedented.

😠 Haters

“Is this financial advice?”

No. Don’t trust anyone’s research but your own.

“Mining harms the environment.”

Layer 2 solutions are live. Proof of Stake is live on some chains and coming to Ethereum.

“CeFi isn’t going away.”

You’re probably right. I think we’ll see “fat” trustless (DeFi) layers and “thin” trusted (CeFi) layers. Anchorage is an argument for intermediaries. Decentralization isn’t perfect. Nothing is.

“I can yield farm in CeFi by moving my money between banks.”

With low rates and high friction. Good luck. DeFi’s 20%+ APYs aren’t sustainable but interoperability is here to stay.

“This will be used for nefarious purposes.”

“But magic is neither good nor evil. It is a tool, like a knife.”

“What about scaling issues? (Gas prices)”

Layer 2 solutions are here. Polkadot and Binance Smart Chain compete with Ethereum.

“This sounds too good to be true. You say there’s no free lunch. What’s the catch?”

You can travel cross country by train but most of us don’t. Flight saves time. But you’ll miss some scenery. CeFi is a train. DeFi is a plane. Net positives are possible. Panaceas are not.

“Some DeFi projects are centralized.”

Centralization helps teams move fast. Some projects progressively decentralize as they mature.

“Crypto is volatile.”

See stablecoins.

“Why are Coinbase and Binance missing from the players section?”

These are bridges between CeFi and DeFi. This report leans towards DeFi.

📁 Related Reports

- DAOs • Decentralization is changing non-financial networks.

- NFTs • If DeFi creates wealth. NFTs create status.

- DeFi (v1) • Our first look at the fast-moving world of DeFi.

🔗 Links

- When Owning Gold Was Illegal in America • “…gold ownership—both in coins and in bars—illegal for all Americans and punishable by up to ten years in prison. Anyone caught with gold would also have to pay a fine of twice the amount of gold that was not turned over to the Federal Reserve in exchange for paper money.”

- The Future Of Finance Explained • A video covering the history and future of finance.

- Robinhood Blocks Buying in GameStop, AMC, and Other Stocks • Centralized exchanges arbitrarily halt trades.

🙏 Thanks

Thanks to Linda Xie (Scalar Capital), Aadil Razvi (Demand Curve), Rick Segal (CRAAG Angel Group), Yarty Kim (Kick Ass Letters), Paul Martin (Lyrico), Vic Kalchev, Abhishek Verma (samkhya.ai), Ozioma Egwuonwu (BurnBright International), Darren Travel (AtomicRoutines) and Jonathan Looney (Nexus Cognitive). We had a great time jamming on this report.

Get Weekly Reports

Join 65,000+ founders and investors

📈 Unlock Pro Reports, 1:1 Intros and Masterminds

Become a Trends Pro Member and join 1,200+ founders enjoying…

🧠 Founder Mastermind Groups • To share goals, progress and solve problems together, each group is made up of 6 members who meet for 1 hour each Monday.

📈 100+ Trends Pro Reports • To make sense of new markets, ideas and business models, check out our research reports.

💬 1:1 Founder Intros • Make new friends, share lessons and find ways to help each other. Keep life interesting by meeting new founders each week.

🧍 Daily Standups • Stay productive and accountable with daily, async standups. Unlock access to 1:1 chats, masterminds and more by building standup streaks.

💲 100k+ Startup Discounts • Get access to $100k+ in startup discounts on AWS, Twilio, Webflow, ClickUp and more.

What you’ll get:

- Players

- 9 Lend + Borrow players (125% More)

- 9 Trade players (200% More)

- 4 Farm players (100% More)

- 4 Index players (100% More)

- 4 Bet players (100% More)

- 4 Insure players (100% More)

- 4 Tokenize players (100% More)

- 8 Predictions (100% More)

- 10 Opportunities (100% More)

- 9 Key Lessons (125% More)

- 10 Links (233% More)

With Trends Pro you’ll learn:

- (📈 Pro) Which protocol reached $1B in days?

- (📈 Pro) What are flash loans?

- (📈 Pro) Who used a flash loan to make $3,000,000 in 30 seconds?

- (📈 Pro) What’s yield farming?

- (📈 Pro) Why are we seeing a (mostly) peaceful transfer of power from nations to networks?

- (📈 Pro) What are protocol politicians?

- (📈 Pro) Why are we seeing yield, liquidity and marketplace aggregators?

- (📈 Pro) What’s a tokenized community?

- (📈 Pro) How to benefit from networks that you contribute to?

- (📈 Pro) Why are assets handicapped in traditional banks?

- and a lot more…